When it comes to investing, the debate on property versus shares is always a hot topic. Is one better than the other? Does one carry a higher risk? Does one offer greater returns?

These are good questions and important considerations when choosing your investment strategy. The truth is, there are pros and cons to each—and the best choice for you will depend on your personal circumstances and goals.

While some feel more comfortable investing in bricks and mortar, others prefer the flexibility of shares. So how do you decide? It comes down to being clear on your goals, educating yourself around your options and talking to an expert. In this article, we’ve put together an overview to help you start the conversation.

Property investment and shares defined

Before diving into the pros and cons, it’s worth spending a moment to define each term clearly. Property investment most commonly refers to purchasing a residential house, townhouse or apartment and renting it out to tenants, but it can also involve commercial property where the building is leased to a business. With property investment, your return is via rental income and capital growth. On the other hand, buying shares means you are buying part-ownership of a company, which means the value of your shares go up and down in line with the company fortunes.

Finding the best fit

While most people want to know which is the better investment option, the truth is, both can be a great choice in the right circumstances. It is more important to understand your ultimate goal (what you hope to get out of the investment) and then match the right strategy to your needs.

For example, the people that are best suited to our Property Portfolio Accelerator are everyday Australians looking for a stable, long-term investment strategy that will provide passive income in retirement to secure their financial future.

If you are looking for investment returns in the shorter term, to fund your lifestyle or meet the needs of your family now, a strategy based around shares may be a better fit.

Is property investment your best fit?

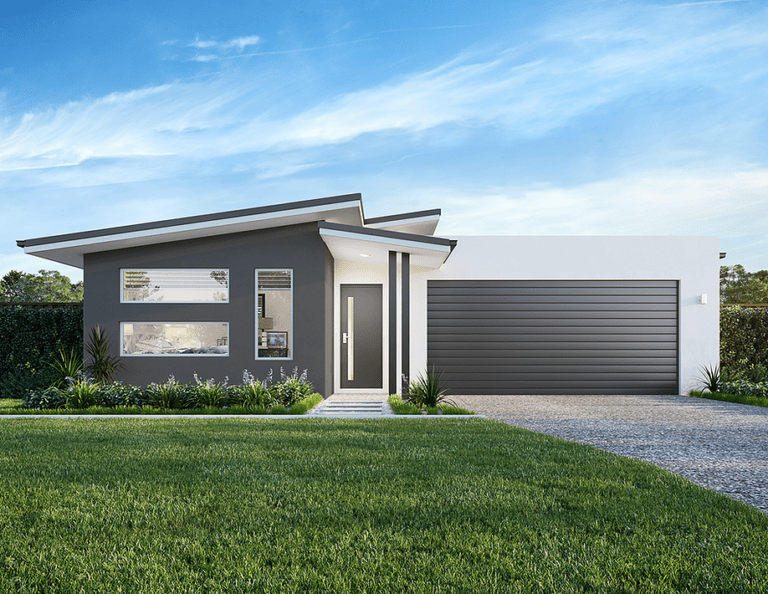

Many people feel more comfortable with the idea of property investment as it is a tangible asset that they can see. On top of this, the potential for substantial capital growth makes it an ideal long-term investment strategy that you can build on to provide a financially free retirement with passive income to fund a comfortable lifestyle. Property investment also offers the benefits of leverage, tax deductions and rental income, which can help to pay down the value of your loan faster.

Here’s 3 key indicators property investment may suit:

- You are looking for long-term financial security

- You want a say in how your money is invested

- The volatility of shares makes you nervous.

Is share investment your best fit?

If you are looking to try your hand at investing without the need for a large capital investment or commitment, shares can be a good place to start. It is possible to build up and diversify your portfolio over time so it is delivering solid returns, and the flexibility to sell your shares and cash out as you need to can be helpful. However, the volatile nature of the stock market means you need to be ready to buy and sell at the right time to maximise your gains.

Here’s 3 key indicators share investment may suit:

- You want to start small with your investment

- You are looking for flexibility in changing your mind

- You’d like to access part of your funds as you need them.

Take the first steps today

If you’ve decided to invest, choosing the strategy that best fits your goals is a must. If you’re keen to take charge of your financial future, and are looking for a proven investment strategy to get you there, our Property Portfolio Accelerator Program could be the ideal fit.

To find out more about how you can purchase an investment property with your super, download our free 10-point checklist, or contact our team on (07) 3011 6260 to discuss your options today!