- Do you want to achieve financial independence in retirement?

- Does the volatility of the share market make you feel nervous?

- Are you ready to secure your retirement through property investment?

While most Australians work hard their whole life, sadly only 5% will ever achieve financial independence. For the most part this is due to lack of knowledge in how to go about it, and also a lack of confidence in deviating from the work/save mindset.

But the truth is, financial independence is within the reach of many of us, and you can get the ball rolling with no money down.

Building a property portfolio inside you super could be the answer

The Property Portfolio Accelerator program connects hardworking Australians with strategic property investment opportunities via their super, that are not otherwise available to retail investors. This investment strategy is a game-changer for those looking to achieve financial freedom and a passive income in retirement.

Achieve financial independence in retirement

Property investment inside superannuation is one of the most effective ways to achieve financial independence in retirement. A self-managed super fund (SMSF) can be a powerful investment tool because it gives you more control and the ability to choose your own investment assets. We can help you explore strategic property investment opportunities so you can enjoy a tax-free early retirement.

By following our strategy and switching your super to an SMSF you can:

- Leverage your super to buy investment properties. This allows you to grow your portfolio over time, allowing you to be financially independent in retirement.

- Earn a passive income from the rental income. When you rely solely on savings or super in retirement, once you spend it, it’s gone. In contrast, a passive income keeps on giving.

On top of this, if you choose to sell one or two properties down the track to pay out the mortgages in your portfolio, you will pay less capital gains tax, especially if you are over the age of 60.

Happy Client Success Story

- Colin Brooks

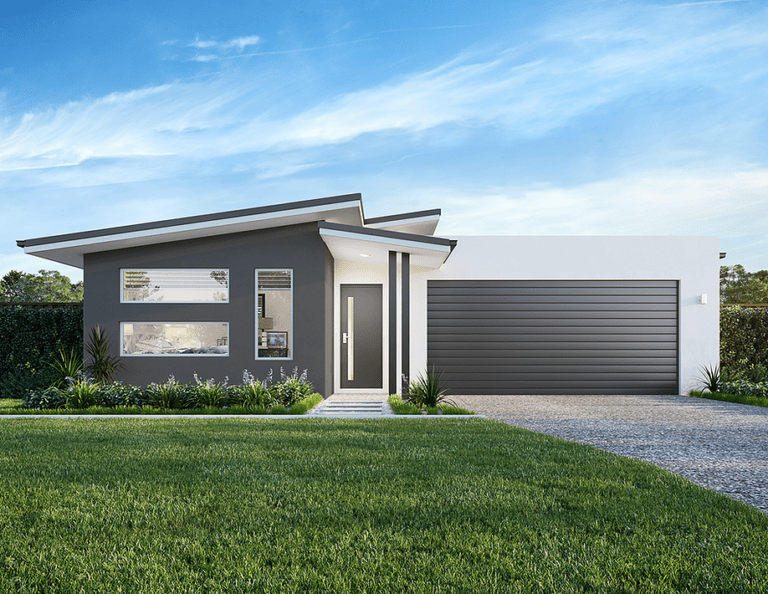

Support in finding the right property

We provide expert guidance on property selection alongside a tailored road map that details how you can build a property portfolio to achieve financial freedom in retirement.

When you partner with us to find the right property and build your portfolio you’ll get:

- a turnkey investment property that is ready for immediate tenancy.

- a property that is located in an area of growth with amenities close by.

- a secure bricks and mortar investment that will generate instant cash flow.

All properties we recommend tick the essential boxes: proximity to a CBD, in an area with long-term growth, with essential services and facilities close at hand. In our learning centre, we discuss our tips on buying the right investment property in more detail.

3-Step Process

1. Switch your super from a retail or industry fund to a SMSF.

2. Build your property portfolio to secure your retirement.

3. Create a passive income from rent to achieve for financial freedom.

Success Story

How we helped Ian and Nikki start their investment portfolio

Ian and Nikki saw family and friends suffer significant financial loss with their super during the global financial crisis. They decide to look for an alternative investment strategy to set themselves up for retirement that carried a lower risk. Through our Property Portfolio Accelerator program, they have now purchased two properties … and counting!

From Our Learning Centre

Low or No Deposit Home Loans

For many Australians, getting onto the property ladder can feel like an unachievable goal. Getting a deposit together is hard, especially when life regularly throws

3 Expert Tips to Help You Buy Property at the Right Time in Australia

Are you considering buying a property, but feel confused about when you should act? In this article we share 3 expert tips on getting the timing right.

Building vs. Buying Your New Home: 5 Key Considerations That Will Help You Decide

Both building and buying can be a great choice, but the key to finding the right fit is to measure it against your circumstances. Here are 5 key considerations.

Low or No Deposit Home Loans

For many Australians, getting onto the property ladder can feel like an unachievable goal. Getting a deposit together is hard, especially when life regularly throws

3 Expert Tips to Help You Buy Property at the Right Time in Australia

Are you considering buying a property, but feel confused about when you should act? In this article we share 3 expert tips on getting the timing right.