When we first talk to people about the possibility of leveraging super to purchase a home or investment property, most are amazed that it’s even an option. Their next question is usually why no-one has ever told them about it before!

We are on a mission to change that, with the aim of educating and helping everyday Australians purchase property by leveraging their super. Our investment strategy is based around setting up a self-managed super fund (SMSF), an option which generally comes with plenty of warnings about the time, effort, cost and risk involved.

While it’s true that SMSFs are complicated and do require a lot of work, you don’t need to do it alone. Our strategy is what we like to call a self-managed ‘managed’ super fund (SMMSF), where you’ll have a team of experts working alongside you, taking care of all the legalities and requirements and providing expert advice on investment strategies to maximise your return.

In this way, it’s much like an industry or retail super fund, where the behind the scenes requirements are taken care of by the fund. However, a key point of difference with an SMMSF is that it’s a private fund that you manage yourself for your own benefit—which opens the door to investing in property and unlocking your super to buy a new or existing home.

There’s no doubt switching to an SMSF is a big decision—so to help you understand more about a self-managed ‘managed’ super fund and consider whether it’s the right strategy for you, read on!

Guidance at every step

As a member of an SMSF you are generally also a trustee, which means you are responsible for complying with all applicable laws and regulations. For the everyday person, this can be daunting, especially when it comes to setting up and managing your fund correctly. With a managed SMSF, you are never on your own—you have an expert team on hand to guide you at every step of the way.

Full control minus the hassle

A key benefit of an SMSF is the freedom to control your investment, however, when you are managing your fund yourself, this can take up quite a bit of your time. When you partner with us, our team of experts take care of all the strategy, paperwork and other necessary tasks, while keeping you fully informed and involved in the decisions around your investments. You get full control of how your super is invested, minus the burden of the admin.

Tailored investments to secure your future

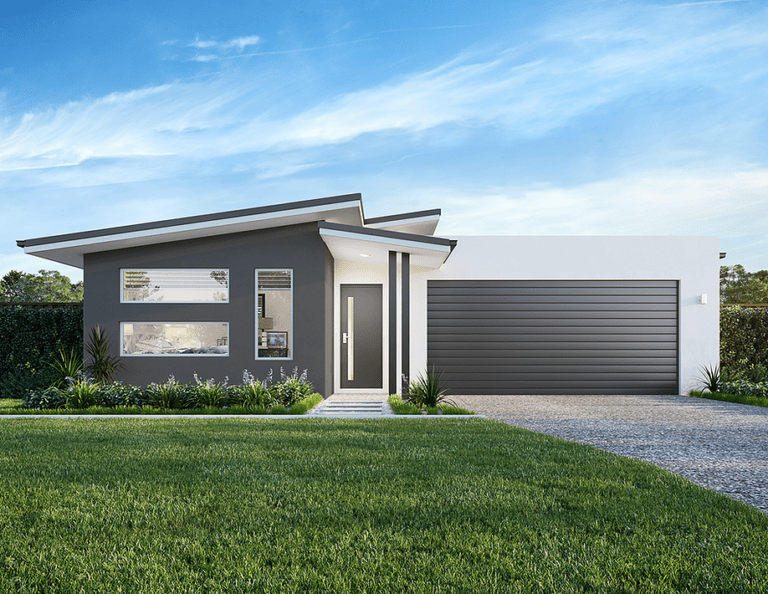

With an SMMSF, your expert team manages your investments for the benefit of you alone, providing a tailored investment strategy to secure your future. Our strategy is based around property investment, and depending on your circumstances will include leveraging your super to secure a deposit to purchase a home to live in, or assistance in buying an investment property to build your portfolio. Either way, the long-term goal is to provide you with a passive income in retirement through tenanted rental properties, so you can secure your financial future. Our expert team and partners are totally committed to helping you achieve this goal.

SMMSF gives you the best of both worlds

With a managed SMSF, you get the best of both worlds: a super fund that is run purely for your benefit without the added burden of keeping up with the reporting and compliance yourself. What’s more, with our HomeBuyer and Property Portfolio Accelerator Strategies, you are able to unlock your super to escape the rental trap and buy a home to live in, or to purchase a rental property and take the first steps towards financial freedom in retirement.

Have a question about SMSFs, SMMSFs or our HomeBuyer or Property Portfolio Accelerator Program? Get in touch with our team on 07 3011 6260 today!